Comprehensive Business Assessment (CBA)

CoMetrics Partners has developed proprietary software(DataMetrics) specific to the Consumer Products Industry that combines leading technology with best-in-class consulting expertise, enabling Lenders to be proactive rather than reactive.

Why Traditional Methods Fall Short

Inventory Appraisals

Relying on NOLV is No Longer Responsible Lending

• Appraisers are not utilizing advanced technology and do not stand behind the appraisals with credit bids.

• Appraisals are generally outdated by the time the report is rendered.

• Borrowers derive little to no actionable value from appraisals.

• Reliance on NOLV has proven to be a false positive and rarely achieved in actual liquidations.

Field Examinations

You should know more about the Borrowers’ business than the collateral.

Traditional Field Exam procedures have:

• No QOE component (i.e., no reconciliation of reported margins to underlying data).

• No true -up of dilution against reserves or accruals.

• No sensitivity of financial forecasts.

• Minimal or no procedures for related -party transactions –recognized as the number one fraud risk by the AICPA.

• Examiners rely on limited testing of small sample sizes, when technology allows 100% of the population to be analyzed.

What Sets Our CBA Apart

Proprietary Technology

Our platform is ERP-agnostic and ingests 100% of transactional data into intuitive dashboards and reports.

Starting with the Analytics

Our platform delivers robust SKU-level inventory insights, enabling advanced coupling/decoupling and precise gross margin tracking. Key features include:

- Granular Inventory Categorization - Real-time visibility across On Hand, In Transit, Work in Process, Replenishment, Amazon FBA, Direct-to-Consumer (DTC), Licensed, Non-Licensed, and Customer-Specific segments.

- Dynamic Fulfillment & Margin Analysis - Tracks open order fulfillment and calculates margins against inventory availability at every stage.

- Aging & Supply Metrics - Independent inventory aging, Month’s Supply analysis, and sales tracking by aging buckets.

- Risk & Performance Monitoring - Flags SKUs sold below lender-defined margin thresholds and detects material cost fluctuations.

- Productivity Insights - Measures SKU performance to guide smarter purchasing and replenishment decisions.

Financial Statement Review

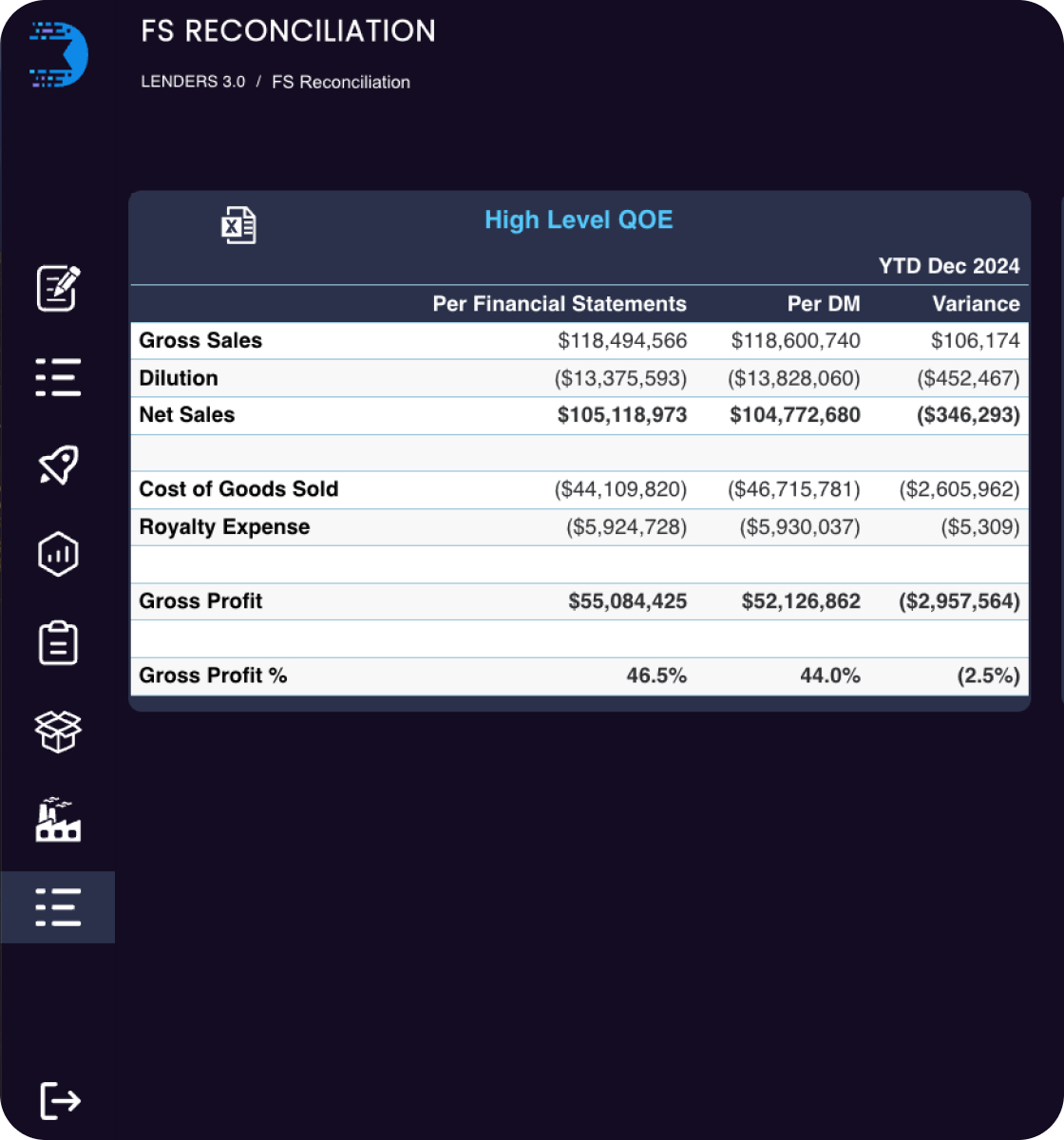

We conduct certain QOE procedures:

- Comparative Profit and Loss Statements

- Reconciliations of margins from underlying data to Financial Statements

- Understanding related party transactions

- AR and inventory reserves veers the analytics

Field Examinations

We’ve reimagined the field exam process by combining advanced analytics with targeted procedures to improve focus and reduce time in the field.

Lead with Technology

Begin with data analytics to pinpoint key risk areas and direct examiners to focus only where necessary.

Targeted Fieldwork

Supplement technology with essential manual procedures such as:

- Ship test

- Cost test

- Tax payment verification

- AP aging analysis

- Insurance policy review

- AR roll forwards

This approach reduces the scope and time of traditional field exams by an estimated 33% to 50%, driving both speed and cost savings.

Still Relying on Appraisals and Field Exams?

Appraisals are static. Field exams are slow. Both are backward-looking and often miss what truly matters. The Comprehensive Business Analysis (CBA) delivers real-time insight into what’s actually driving performance — and where the risks are hiding. If you're making decisions based on outdated tools, you're already behind.